Havana: Cuba released today two new legal provisions that offer more guarantees to businesses with foreign capital and avoid damages to investors, Prensa Latina publishes.

Decree-Law 14, approved by the Council of State last September and published this Friday in the Extraordinary Official Gazette number 58, provides confidence and security to foreign investors through actions such as the mortgage and the pledge.

According to María del Carmen March, legal director of the Ministry of Foreign Trade and Foreign Investment (Mincex), legal regulations allow businesses with external capital to pledge their assets and rights with prior authorization from the Council of Ministers.

In a meeting with the press, the specialist specified that the decree also authorizes the use of the mortgage on real estate or real rights in sectors of special economic interest, after the express approval of the highest governing body of the country.

Likewise, the provision determines that the State has a preferential right to acquire the mortgage securities, March said.

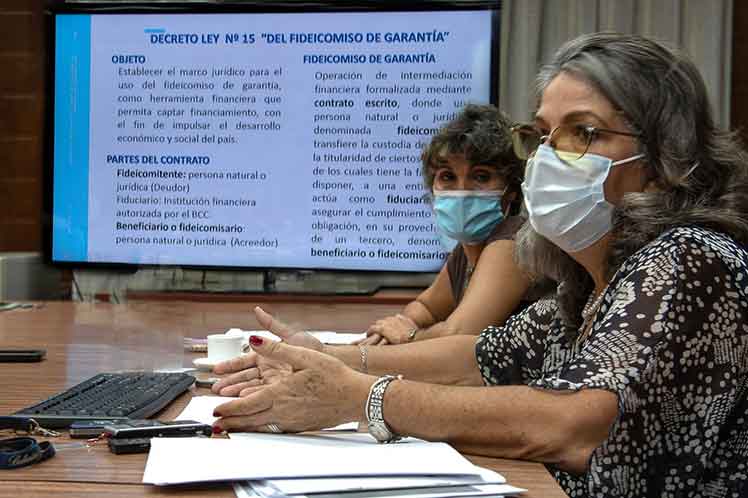

For its part, Decree-Law 15, published in the same number of the Official Gazette, establishes a legal framework for the use of the trust as a guarantee tool.

In this way, through a written contract, a natural or legal person can transfer custody of assets or ownership of certain rights to a financial entity, the secretary of the Central Bank of Cuba, Marta Lussón, said.

In that case, she pointed out, the approval of the Council of Ministers or the Council of State must also be obtained.

These types of actions already existed in Cuban legislation, but now the possibility of their use is being extended to other actors in the economy to support external financing, the officials considered.

Likewise, the use of these regulations, which will come into force within 30 days, will promote access to external forms of financing and thereby contribute to the development of various areas of the national economy.

Recently, Cuba approved other incentives for foreign investment such as the possibility of receiving a tax credit of between 10 and 30 percent of the payment on profits to joint ventures that carry out exports.